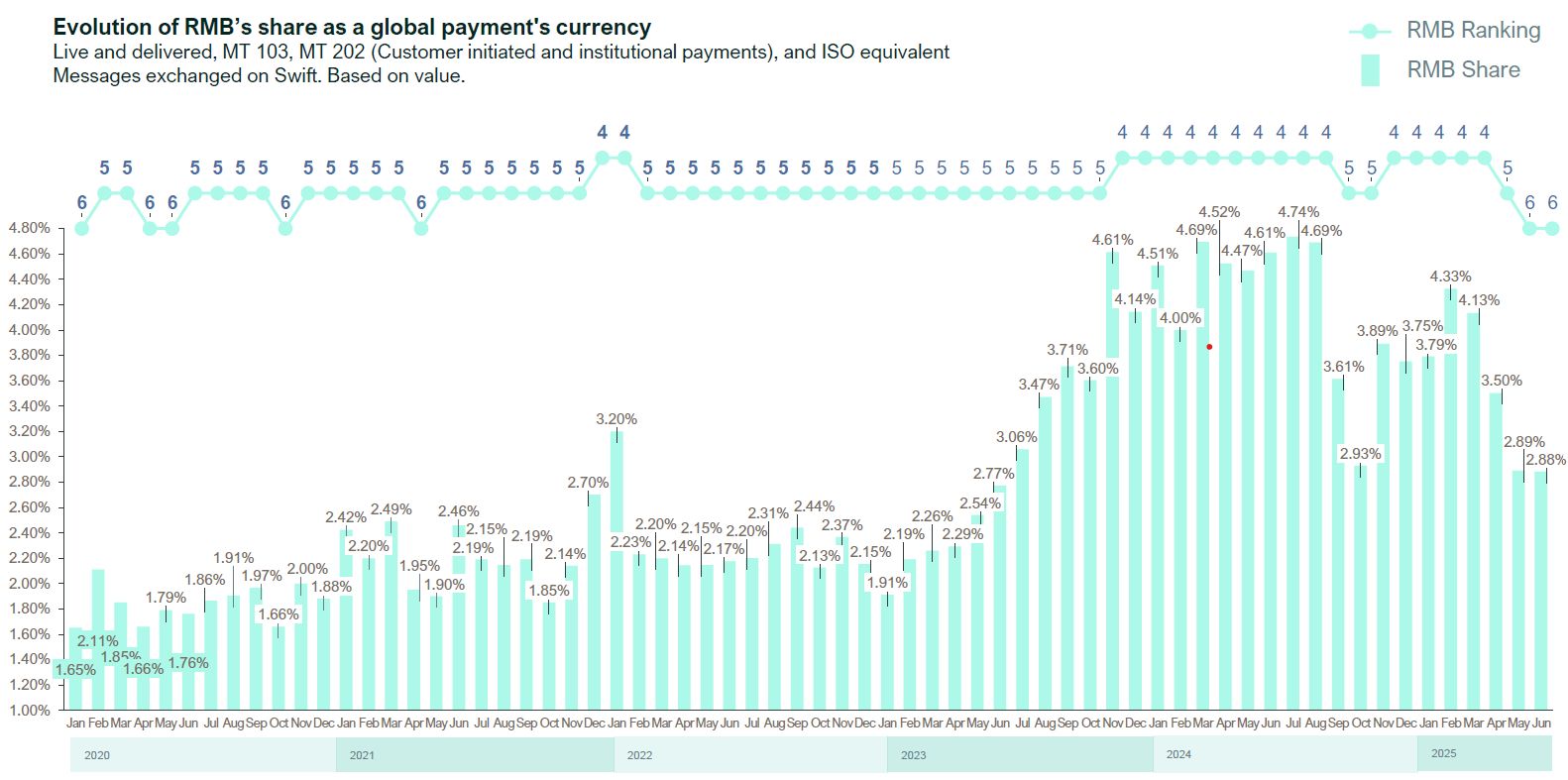

The renminbi fell to sixth place in May and June 2025 in terms of its share as a global payment currency, the first time it slipped outside the top-five rankings since May 2021, according to Swift’s latest RMB Tracker.

China-US trade tensions, the uncertainty over US President Donald Trump’s “reciprocal tariffs”, and structural issues around RMB liquidity continue to pose hurdles to the Chinese currency’s wider usage. On the other hand, the Chinese government is proactively pushing for the currency’s internationalization.

RMB’s share of global customer-initiated and institutional payments also dropped significantly, from 4.33% in February to just 2.88% in June. And despite increasing global discussions around “de-dollarization”, the US dollar remains the dominant currency for international payments and trade invoicing. Next to the greenback are the euro, British pound, Japanese yen, and Canadian dollar.

Source: Swift RMB Tracker

Source: Swift RMB Tracker

In inter-group trade finance transactions, the RMB held a 5.94% share in June, slightly edging out the euro’s 5.90%. However, the US dollar continued to dominate the space with an overwhelming 82.75% share, underlining its continued central role in global finance.

China’s trade transition is another factor weighing on RMB usage. In May 2025, China’s exports grew by just 4.8% year-on-year, while exports to the US dropped by about 34% due to the tariff uncertainties, according to Trading Economics. Although most trade between China and the US is settled in dollars, the broader decline in cross-border flows likely reduced yuan-denominated trade payments. Meanwhile, China’s trade has increasingly shifted towards other regions such as Asean, the Middle East, Africa, and South Asia.

A major structural issue is the concentration of offshore RMB liquidity in Hong Kong. In June 2025, three-quarters of all yuan transactions outside mainland China were processed through Hong Kong banks and clearing houses, with the United Kingdom and Singapore trailing far behind at 6.42% and 3.81%, respectively, according to Swift. This centralization makes the offshore RMB market highly sensitive to any disruptions in Hong Kong.

RMB flows outside Swift

However, it’s important to recognize that Swift’s data only covers a portion of global RMB usage. More and more Chinese trade and investment flows – especially those involving small exporters, e-commerce platforms, or politically affiliated projects – take place outside the Swift network.

These transactions often use China’s own Cross-Border Interbank Payment System ( CIPS ), as well as platforms like Alipay, PayPal, or regional correspondent banks. CIPS, launched in Shanghai in 2015, has been expanding rapidly and now covers over 180 countries. In 2024, it processed 175 trillion yuan ( US$24.37 trillion ), up 43% from the previous year, according to CIPS’ data.

Despite the recent setback, Chinese authorities appear determined to internationalize the RMB. The government has issued new guidelines for cross-border financial services, encouraged state-owned enterprises to use RMB in overseas transactions, and expanded payment infrastructure abroad.

People’s Bank of China governor Pan Gongsheng has called for a multi-polar currency system. He has overseen investments in digital yuan infrastructure, such as a new operations centre in Shanghai as well as pilot cross-border CBDC ( central bank digital currency ) programmes.

Meanwhile, major banks in countries like India and the United Arab Emirates, and across Africa are gradually connecting to CIPS. Chinese tech firms are even proposing offshore RMB-pegged stablecoins to support regional trade settlement.